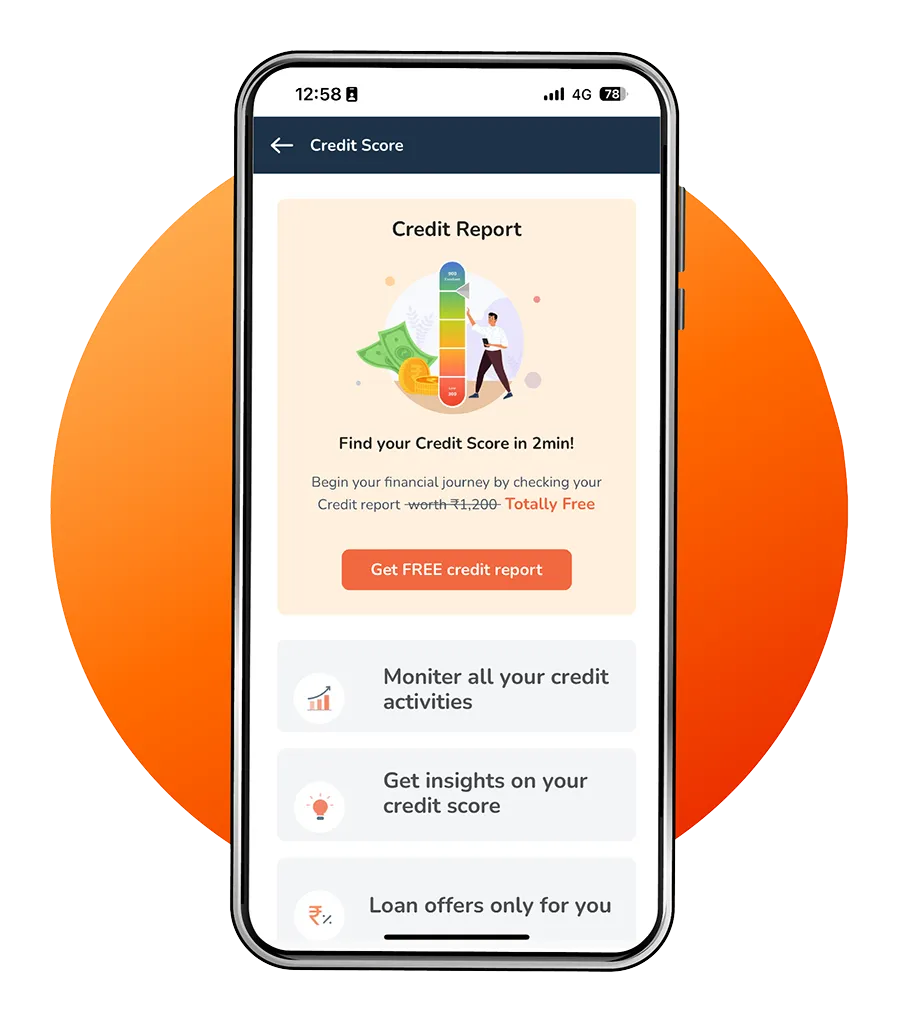

Where Credit health meets financial wellness

- Free Credit Score

- Predict Your Future Score

- Tips for Credit Health

- No Impact on Your Credit Score

Please wait...

Simulate your credit reports in seconds with

The Score Simulator is a tool that enables you to simulate different credit behaviors on your credit report and thus its impact on Equifax score.

Try NowA credit report is a detailed summary of someone's financial history, focusing on borrowing and repaying money. Credit bureaus or reporting agencies compile it and include information such as:

Name, address, social security number (for individuals), and other identifiers.

Details about loans, credit cards, and lines of credit, including payment history and status.

Records of timely payments, late payments, defaults, or missed payments.

Information from public sources, like bankruptcies, tax liens, or court judgments.

A list of inquiries that affect overall credit score.

Ratio of credit used to the total available credit.

Credit reports help lenders, creditors, and employers assess creditworthiness, impacting loans, credit terms, interest rates, and jobs. Regular reviews detect errors, ensure accuracy, and guard against fraud.

You can get an online credit report easily. Additionally, there are many benefits to checking your credit score. These include:

A Credit report is a comprehensive overview of a person's credit history. It contains information about their borrowing activities in the credit sector. CRAs keep track of a person's borrowing activities. They use this information to calculate their credit score and it ranges from 300 to 900.

Enter your mobile number linked to your bank account.

Enter the OTP received on your mobile number.

Enter your PAN card details, which include your PAN number, name and date of birth.

Confirm details to generate Credit Report

Access Credit Report Through Mobile or Web

A Credit Score is an integral part of anyone’s financial status. It is a three-digit number from 300 to 900 that shows if someone can pay back loans or debt. Financial institutions often base this number on the consumer's repayment and credit history. Let us learn about the different credit score ranges and what they mean.

Maintaining a high Credit Score has plenty of benefits, from more lender choices to low-interest rates. Let’s check these benefits in detail

High Credit Limit

Maintaining a high Credit Score has plenty of benefits, from more lender choices to low-interest rates. Let’s check these benefits in detailLower Interest Rate

Maintaining a high Credit Score has plenty of benefits, from more lender choices to low-interest rates. Let’s check these benefits in detailIncreased Negotiating & Purchasing Power

A good credit score helps you get pre-approved loans for a home or car, enabling better negotiation and faster deal closures.You can get an online credit report easily. Additionally, there are many benefits to checking your credit score. These include:

Pay Bill on Time

Reduce card Utilisation

Monitor Reports for Errors

Do Not Open Many Credit Accounts

Maintain Mix of Accounts

The table below outlines the key differences between a credit score, credit report, and credit rating.

Credit Report

It is a comprehensive, summarized copy of your credit history and resembles your creditworthiness. Most lenders use this document as your credit reference.Credit Score

It is a 3-digit summarized version of your credit report. It considers all the information on the report, measures your credit risk, and computes an overall score ranging between 300-900.Credit Rating

After determining whether you can fulfil your financial commitments, credit bureaus provide credit ratings to businesses and even governments. Credit ratings show lenders how likely you’re to repay loans.The table below outlines the key differences between a credit score, credit report, and credit rating.

| NA or NH | NA stands for Not Applicable, and NH stands for No History. NA in your credit report means there is no information available about your credit history. Since the report does not include any credit information, we also refer to it as NH. |

| STD | STD in credit report stands for ‘Standard.’ You’ll find this term in your loan accounts and credit report. In your report, `STD` indicates that you have paid all outstanding amounts within 90 days, or on the due date. |

| DBT | DBT here stands for Doubtful. It means that one of your loan accounts has stayed/remained as a Sub-Standard account for a year (12 months). |

| LSS | It stands for Loss. It implies that we have detected a loss in one of your accounts. LSS on your credit report means that you haven’t paid that loss amount, and it’s still uncollectible. |

| SMA | SMA stands for Special Mention Account. This indicates that we have established a designated account to record Standard Accounts that have shifted to Sub-Standard. In such cases, we receive payments after 90 days of the due date. |

| DPD | The full form of DPD is Day Past Dues. It serves as a track of your credit accounts’ payment schedules. The DPD area shows your payment, even though it is one day late. You can model DPD in one of two ways: Note or Numeric. |

Equifax is a top company that uses data, analytics, and technology to give information about consumer and business credit. Equifax is a well-known credit bureau that helps businesses and individuals understand and manage credit risks with various solutions.

Equifax's credit reports and credit scores are instrumental tools utilized by lenders, financial institutions, and businesses to evaluate creditworthiness and facilitate informed lending decisions. With a commitment to data accuracy and innovative analytics, Equifax empowers its clients to make sound financial decisions and navigate the complexities of risk management in today's dynamic financial landscape.

Credit Information Bureau (India) Limited (CIBIL) is India's premier credit information company. This is a crucial component of the country's financial system.

It provides credit scores and detailed credit reports. These reports display the credit history of individuals or companies. Banks, lenders, and financial institutions use CIBIL's credit reports to assess creditworthiness for loans and credit cards.

The CIBIL score is important for lenders to decide if they should give a loan. It shows the risk of the person's credit. CIBIL's insights are pivotal in facilitating responsible lending practices and enabling individuals to access credit opportunities aligned with their financial profiles.

CRIF is a top company that focuses on credit bureau, business information, credit scoring, and credit management. People know CRIF for its credit services. It helps businesses, banks, and people make smart financial choices with its complete solutions.

CRIF uses advanced technology and data analysis to provide useful information and tools for managing credit and preventing fraud. They help businesses in different industries worldwide with efficient credit management.

Experian is a global information services company known for its expertise in data analytics and providing insights into consumer and business credit information. Experian helps businesses, people, and groups make smart financial choices with different services.

Lenders and institutions use credit reports and scores to evaluate creditworthiness and manage lending risks globally. Experian helps businesses use reliable data to reduce risks, improve customer relationships, and make informed decisions.

Checking your credit score gives you a clear picture of your loan eligibility. A higher score (750+) not only increases your chances of getting a home loan sanctioned but also helps you secure a better home loan interest rates . With Piramal Finance, a strong credit score can lead to lower interest rates, faster approval, and overall better loan terms.

It is natural for your credit score to keep changing over time. Your credit score changes when new information is sent to the three national consumer reporting agencies (CRAs).

Piramal Finance offers personal loans to applicants who have a credit score above 650.

A score above 750 is considered good. It shows that you are financially responsible, making you a strong candidate for home loan approval from Piramal Finance.

No. Not everyone can view your credit report.

To perform a credit report check, you require a PAN card since the credit score links to the PAN card number. Also, individuals need PAN cards for tax return filing and address verification.

A hard credit query may lower your credit score by up to 10 points. This harm may not always be that severe.

A Credit report is a useful tool for banks and NBFCs. It helps them to assess an individual's reliability and creditworthiness. This helps them to determine their ability to repay any debts in a timely manner. The significance of the credit score thus lies in the individual’s risk assessment.

Unfavourable data that is true cannot be changed and usually stays on your credit reports for seven years. Creditors look at your Credit reports to evaluate your past debt repayment history. They use this information to decide if they will give you credit and what terms to offer.

To fix a mistake in your credit report, start by telling the credit agency about the wrong information. You must provide copies of supporting documents and a written explanation of your claim.

Prospective lenders, present creditors, insurance providers, and occasionally even your employer can check your credit score. These individuals and institutions have the authority to examine your credit history. They can do so when you request credit or after they have granted you a loan or credit.